Industry survey shows an urgent, high risk to the availability of IVD medical tests once the new IVD Regulation fully applies in eight months.

Posted on 09.09.2021

09 September 2021 – MedTech Europe, the European trade association for the medical technology industry including diagnostics, medical devices and digital health, ran a survey in July 2021 to gather data from IVD manufacturers on the state of the IVD market today and how they are expected to transition to the IVD Regulation within ten months from the survey date. The survey, which represents an estimated 90% market revenue coverage, was commissioned by the Competent Authorities for Medical Devices (CAMD) Task Force on Certification Capacity Monitoring. The full survey report may be read here.

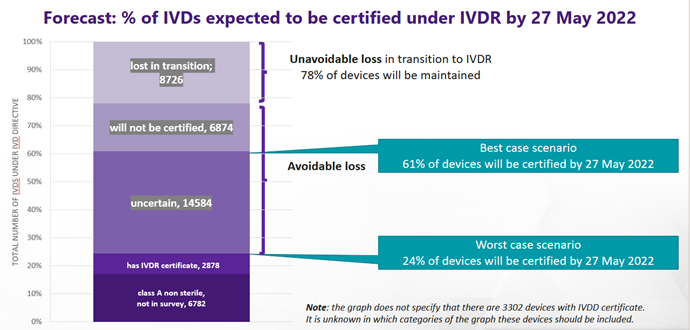

The survey data shows that at least 22% of IVD tests on the market today will be discontinued for the IVD Regulation. In addition to this, many more IVDs are not expected to receive certification by the deadline of 26 May 2022 under the IVD Regulation. The highest proportionate loss of IVDs will come from small and medium sized manufacturers, many of whom make niche products in smaller volumes and who may be more prone to run out of business. From the survey data, MedTech Europe estimates a best-case scenario where 61% of today’s IVDs will be certified by 26 May 2022 and a worst-case scenario where only 24% will (see Figure 1). This margin of uncertainty comes from the data showing that Notified Body certificates had not yet been issued for 88% of IVDs 10 months ahead of the IVDR application: this is consistent across all risk classes. IVDs which require one or more Notified Body certificates under the IVD Regulation but do not have their certificate(s) by 27 May 2022, must be removed from the EU market (transitional provisions may apply but are limited in scope).

Figure 1: IVD Regulation certification forecast for 27 May 2022 based on July 2021 survey data

“The pandemic has shown Europe how significant IVD medical tests – like COVID-19 tests – are to our healthcare systems. Europe’s leaders need to act decisively to put in place the right elements in the system and then give enough time to allow all IVD medical tests to get certified to the new IVD Regulation. If these two conditions are not met, then we predict the loss of a large number of critical diagnostics to Europe’s patients across every medical discipline and risk class.”, Serge Bernasconi, CEO of MedTech Europe, said.

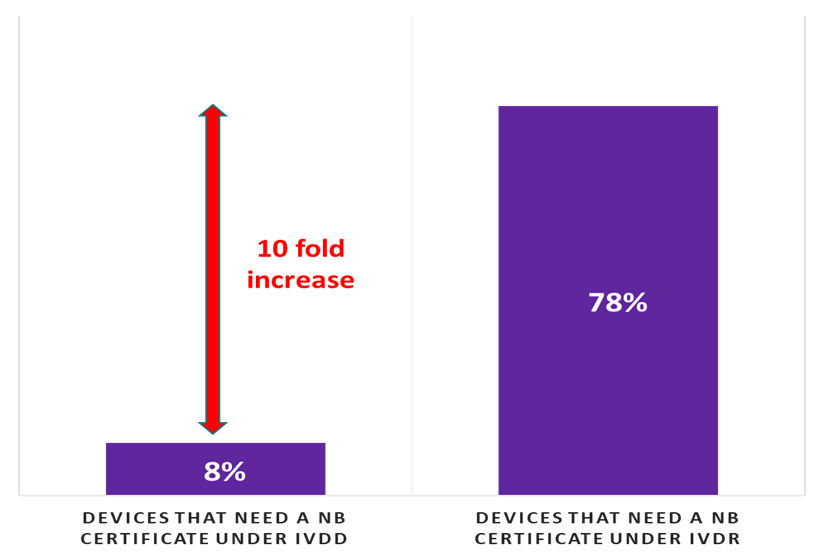

The survey further shows that 53% of manufacturers report that they are unable to sign with a Notified Body to certify their quality management systems and IVDs. SMEs are disproportionately affected by the lack of Notified Body – 64% of SMEs do not have a contract with even one Notified Body compared with 25% of large manufacturers who do not. There is a ~10-fold increase in the number of tests needing Notified Body certificates under the IVD Regulation as compared to today’s IVD Directive (see Figure 2). While Notified Body capacity was cited by respondents as a top concern, it was not the only infrastructure challenge. 74% of manufacturers who responded to the survey reported issues in starting or completing certification.

Figure 2: Percentage of devices that need a Notified Body certificate under IVD Directive and IVD Regulation

MedTech Europe has previously called on EU decision makers to urgently find solutions that give the IVD regulatory system sufficient time to be ready to operate. Any such solution must first ensure that a minimum viable infrastructure is in place, including ensuring sufficient Notified Bodies are designated.

MedTech Europe members are strongly committed to complying with the IVD Regulation but can only do so when the new regulatory system is operational and allows for it. This survey indicates how urgent the need is for EU decision makers to take action on the IVDR regulatory framework and the fast-approaching date of application, to safeguard and support medical diagnostics in Europe.